About Us

About Us

Overview

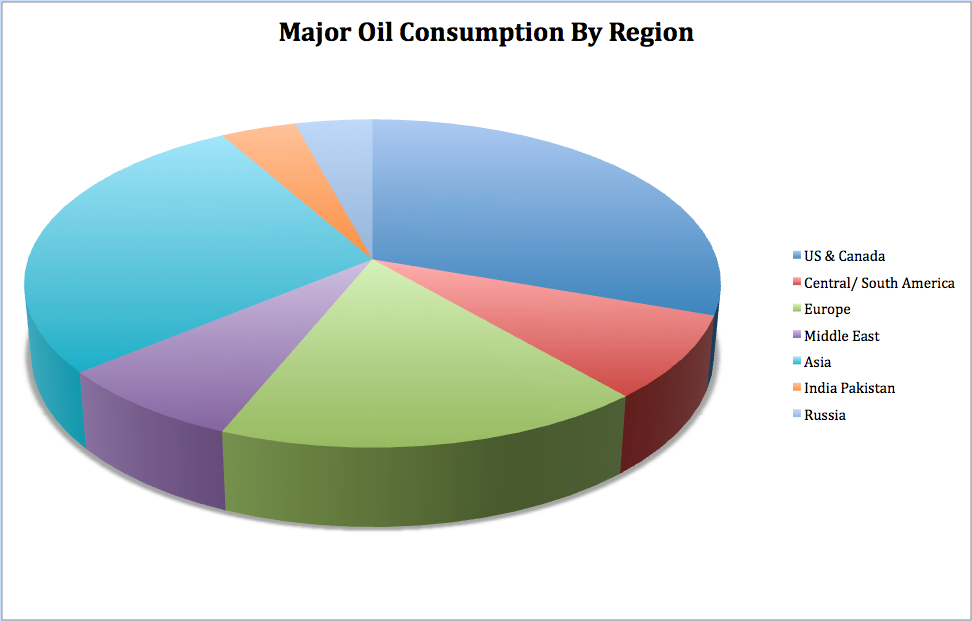

Crude petroleum is the largest single source of energy in the world, accounting for approximately 35–40% of energy consumed in the world, and is the basic building block for a large number of chemical products consumed globally. In early 2010, global crude petroleum demand was slowly recovering after the first decline in growth since the early 1980's. Demand growth in the US, Japan, and Western Europe will be slow as domestic economies start to improve. In regions such as South and Central America, Africa, Middle East, and Eastern Europe where domestic demand is slowly on the rise, growth will be more robust as markets give way to exports. Asia continues to experience the greatest demand growth and a focus on domestic development. World oil demand is forecast to increase steadily 1-2% through 2011 and rise to 2% for 2012-2014.

"The easy oil is coming to an end," says Alex Munton, a Middle East analyst for the Scottish energy consulting firm Wood Mackenzie.

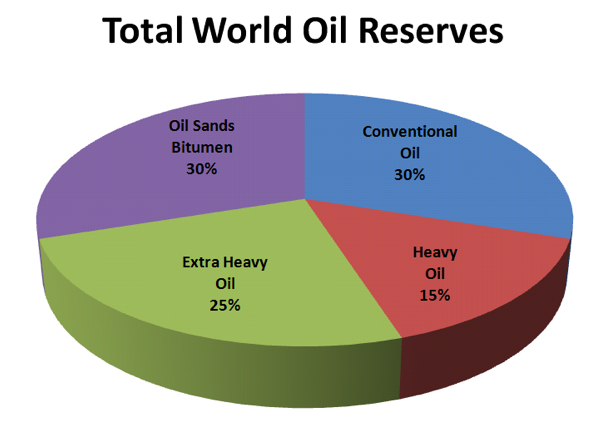

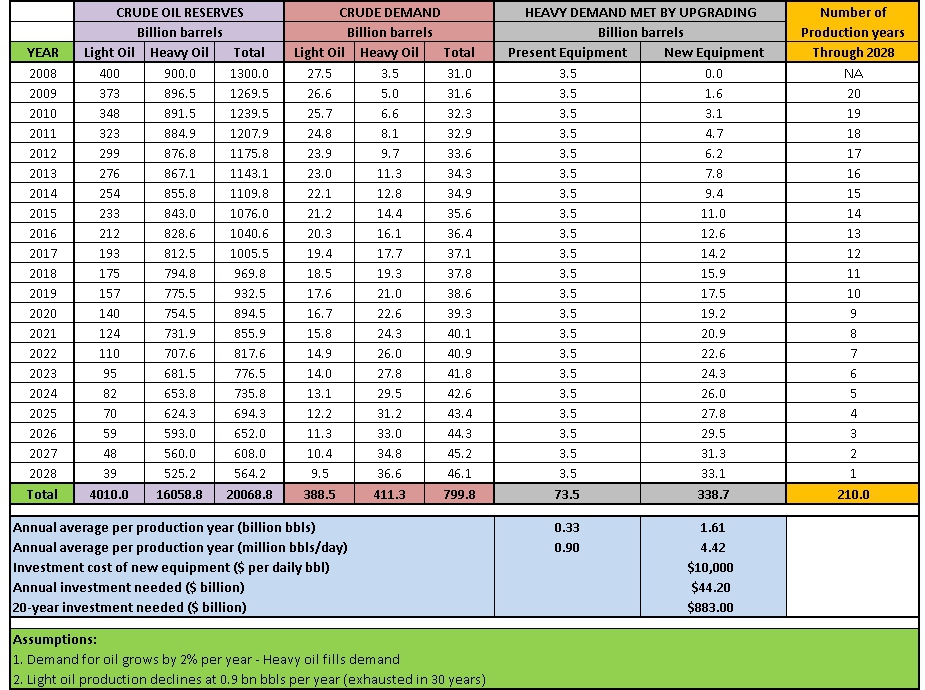

As of January 1, 2010, the estimated world proved reserves of crude petroleum were 1.2 billion barrels. OPEC currently accounts for 71% of total world oil reserves. Saudi Arabia holds the single largest share of the world's petroleum reserves at 19% of the total. On a regional basis, the Middle East accounts for nearly 56% of the world's reserves. North America is second with 15%, and Central and South America is third with 9%, following recent reserves identified in Brazil and Venezuela.

The International Energy Agency (IEA) estimates that 70% of the world’s remaining oil reserves consist of heavy, high sulfur "sour" crude. Oil companies must either seek new sources of lighter, easier to extract and refine, crude oil or find new methodologies to utilize the world’s existing heavy oil reserves. Since the cost for exploration, production and processing continues to climb, the focus should be on the maximum utilization of known reserves by recovering more of the original oil-in-place (“OOIP”) and producing more usable consumer products during refining. The average sulfur content of U.S. Crude oil imports increased from 0.9% in 1985 to 1.4% in 2005, and the slate of imports is expected to continue to sour in coming years. Crude oils are also becoming heavier and more corrosive than they were in the past, largely because fields with higher quality varieties were the first to be developed, and refiners' preference for quality crude oil has led to the depletion of those reserves over the past 100 years reducing the market share of light, sweet crude that remains.

Published reports indicated that at year-end 2007 there were 650 major refineries located around the world. These refineries process a total of 85 million barrels of oil per day. As the sources of premium light-sweet crude oil are depleted, OPEC and other global oil producers will be forced to use increasing amounts of existing heavy-sour crude oil to supply world demand. Not only will additional refining capacity be required to process the increase supply of crude oil, but refineries will need to be designed to process heavier, lower quality crude oil in order to yield the same amount of transportation fuel. For example, premium crude oils yield almost 70% of their volume as light, high-value products (gasoline, diesel, jet fuel, kerosene), whereas heavier crude oils yield only about 50% of their volume as light products. So in order to produce the same amount of refined product from heavy, sour feedstock, a refinery has to have 1.4 times as much capacity (70 divided by 50). There would need to be 182 refineries built (52 more) in order to supply the world with the equivalent amount of transportation fuel in 2017.

As of January 1, 2010, the US had a reserve to production ratio of approximately ten years, while Russia had a reserve production ratio of seventeen years. Opec nations have a reserve ratio of 92 years while oil producing nations in the Middle East has an average of over 100 years.

GHU® TECHNOLOGY DEVELOPMENT HISTORY

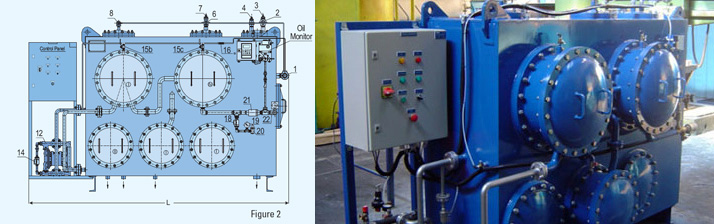

Starting in May 1998, Genoil (formerly CE3 Technologies Inc.: Canadian Environmental Equipment and Engineering Technologies Inc.) researched innovative processes for the upgrading of heavy crude oils. Because heavy oil reserves account for the majority of total world oil reserves (including non-conventional oils), Genoil had realized that highly efficient processes were required to economically upgrade these heavy oils to lighter products.

To deliver the heavy oil to the market, heavy oil producers blend it with lighter oils, called condensates or diluents. This requires the implementation of an extensive infrastructure to produce the light oils and to deliver them to the heavy oil field locations. Further, this concentrated demand for light oils for blending could results in shortages and high prices.

Our concept is to upgrade on-site heavy oils to lighter oils meeting pipeline specifications, eliminating the need for blending, increasing the value of the heavy oils, and having a process with economically viable capital and operating costs even for a small-scale field unit of 10,000 bpd. Of equal or greater importance was the development of a hydroconversion upgrader technology for refineries for raising the API gravity of crude oils to refinery specifications and for recovering the refinery’s heavy residuals. Reduction of sulphur, nitrogen and metals was also a similarly critical goal.

Global consumption of fossil fuels is increasing every year and the demand for crude oil is expected to exceed 115 million barrels per day within the next fourteen years. Meanwhile, no new refineries have been built in the United States since 1976 but the race to add refining capacity around the world has already started. Although existing refineries can process most types of crude oil produced today, the yield of transportation fuel is reduced and waste byproducts increased due to the high sulfur and metal composition of the feedstock. For example, it takes nearly three barrels of heavy crude oil to produce the same amount of transportation fuel that is refined from one barrel of light sweet crude. By 2025, the amount of heavy oil produced could be as high as 60% of the total supply based on current trends in new oil discoveries (i.e., limited replacement of depleted oil reserves) and the OPEC basket “blend” of crude oils.

According to USGS statistics, the supply of heavy crude oil to be produced from conventional reservoirs in the North America alone is estimated to be 35 billion barrels using a conservative recovery factor of only 13%. Based on OOIP calculations, an additional 135 billion barrels of oil could be produced from existing US fields using enhanced oil recovery methods. Comparable estimates are available for proven oil basins in South America and the Middle East. The Upstream Optimization Process including advanced waterflood solutions offers oil producers an efficient, cost-effective approach to enhanced oil recovery.

No comments:

Post a Comment